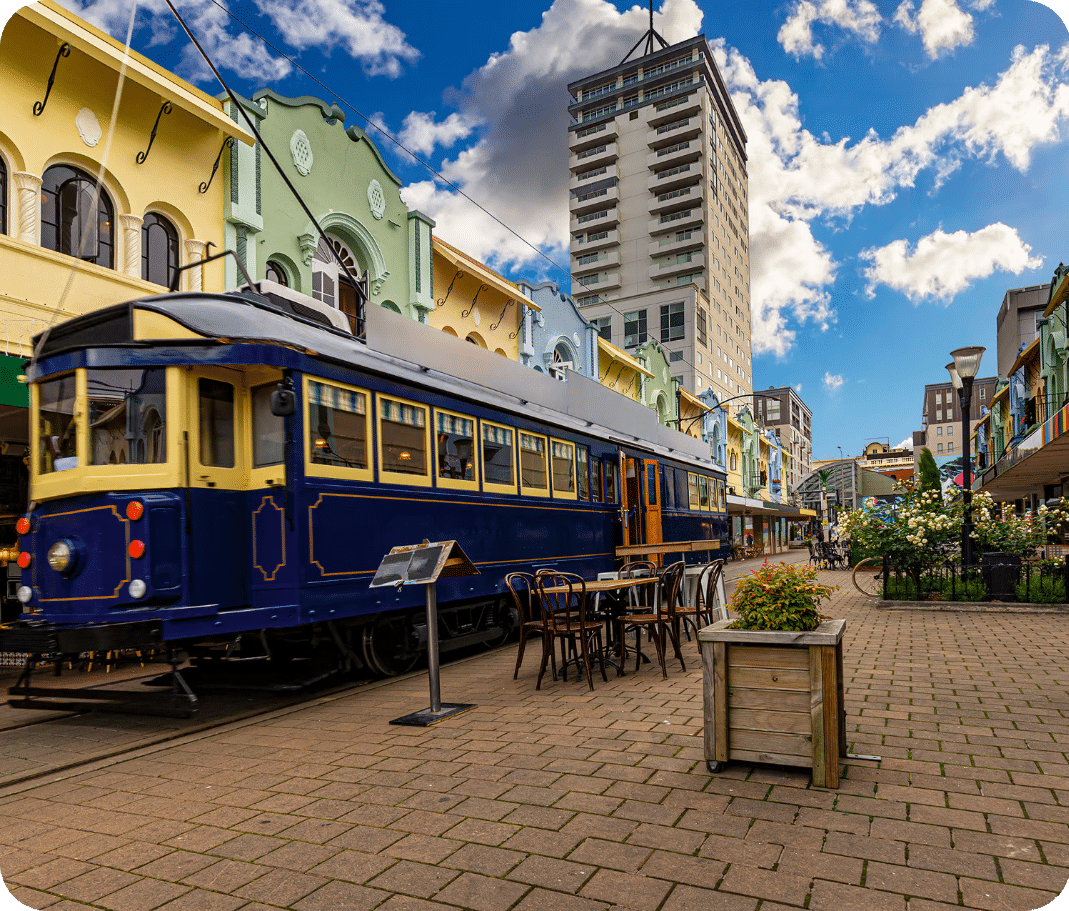

Greenlight Insurance Brokers understands that protecting your assets should be a priority. Our personal insurance solutions are designed to provide peace of mind, and options include:

Home Insurance: Our home insurance policies are tailored to cover everything from minor repairs to complete rebuilds, ensuring your home remains your sanctuary, no matter what the future holds.

Contents Insurance: Protect your cherished possessions with our contents insurance. Whether it's replacing lost, broken, or stolen items, we've got you covered.

Vehicle Insurance: Keep your vehicles, from everyday cars to prized classics, safeguarded against accidents, damage, or theft with our comprehensive vehicle insurance.

Special Items Insurance: From drones to jet skis, caravans, and more, we provide specialised coverage for your unique possessions.

Specialist Property Coverage: Whether you're involved in Airbnb hosting or own lifestyle properties and body corporates, we can arrange customised insurance coverage to address your needs.

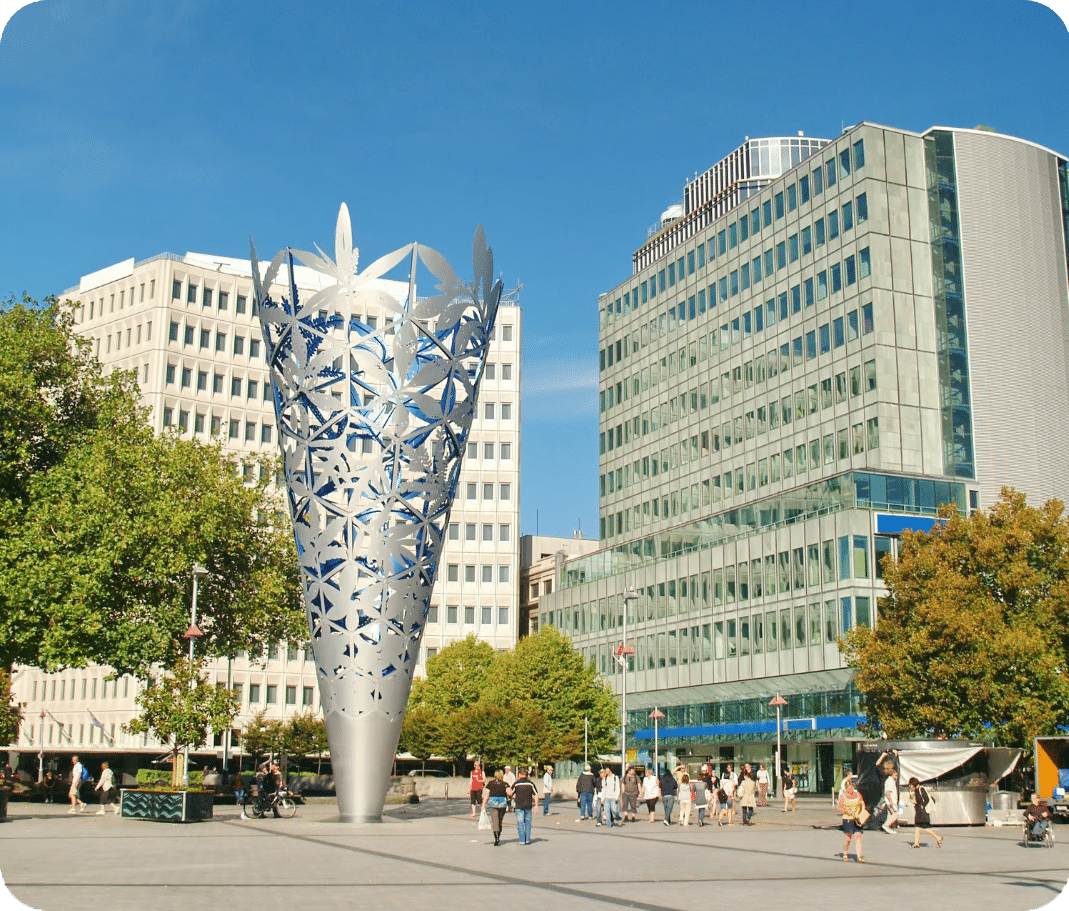

We're here to provide you with the peace of mind that comes from knowing your personal assets are well-protected. You can rely on our experienced Christchurch insurance broker team for comprehensive insurance solutions for Canterbury clients. Contact us today.

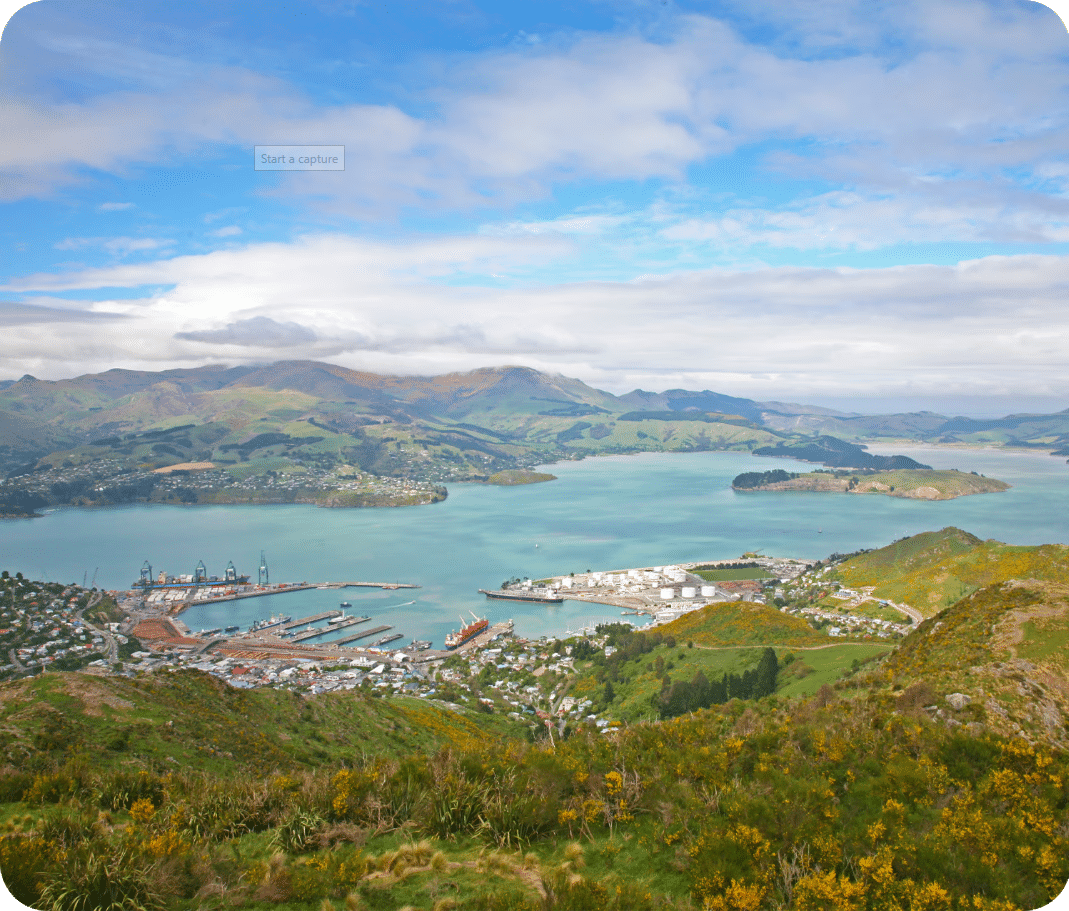

As a business owner in Christchurch or Canterbury, you'll understand that protecting your assets and preparing for the unexpected is paramount. As experienced insurance brokers, the team at Greenlight Insurance Brokers delivers tailored insurance solutions for businesses, addressing various requirements. This includes protection for landlords seeking to mitigate rental losses, tradespeople and manufacturers requiring coverage for business interruptions, and consultants needing personal liability coverage.

We are also well-versed in assisting you in safeguarding against cyber risks, including protection against electronic data theft or loss. Contact us today to arrange a consultation and explore the full spectrum of insurance solutions customised for the unique needs of our Christchurch and Canterbury customers.

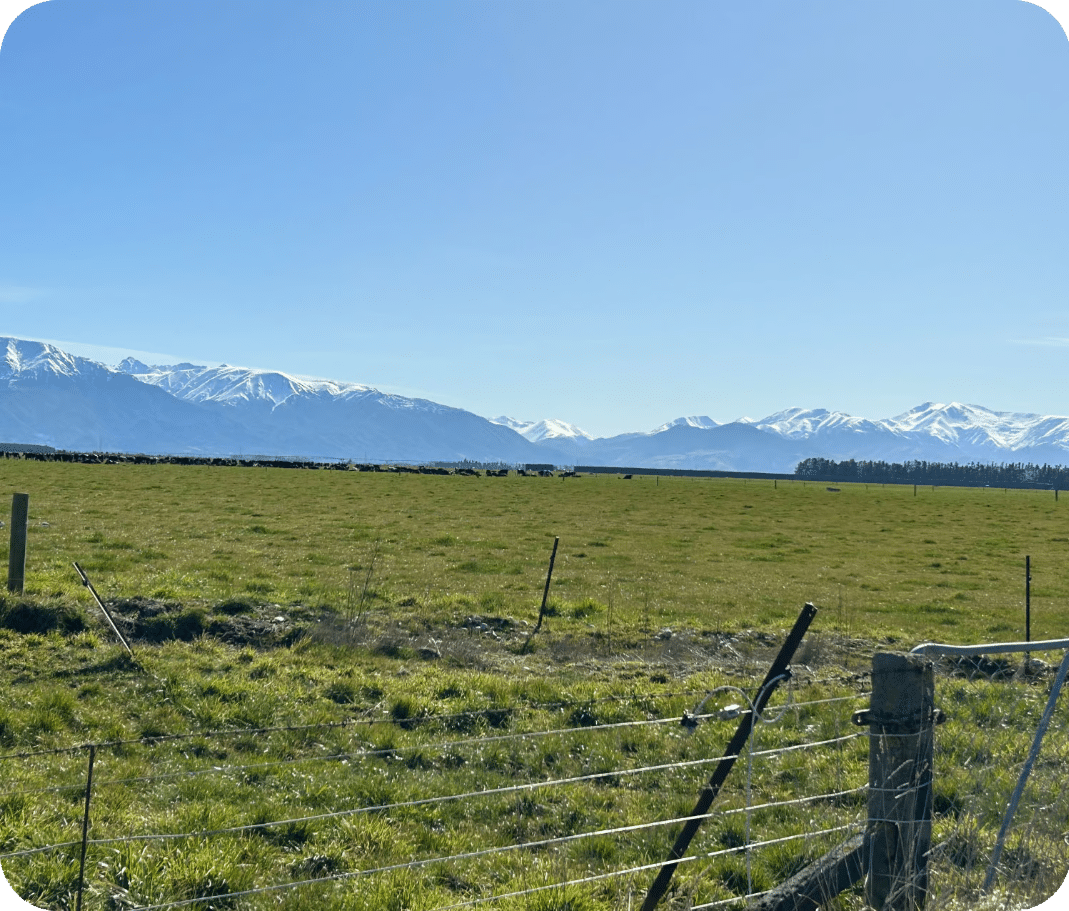

Managing a rural property or lifestyle farm can be a complex endeavour, often fraught with risks associated with weather events, crop and animal diseases, and environmental challenges. The right farm or rural insurance can alleviate the worry of what happens if things go wrong.

Our mission is to support you in acquiring the appropriate coverage to protect your structures, equipment, crops, and other assets, along with addressing your liabilities, encompassing aspects of health and safety and potential contamination issues. We also extend our expertise to rural contractors, ensuring they are comprehensively insured against accidents or liability breaches.

Don't hesitate to contact us today to discuss your rural insurance needs.

The forestry sector is known for its challenges, marked by unforeseeable incidents, such as accidents and forest fires, which can have a profound impact on your business. Our experienced insurance brokers in Christchurch understand forestry insurance, and can collaborate with you to develop custom insurance solutions that cater to your current requirements and evolve with your changing needs over time.

Contact us to connect with one of our specialised brokers who can provide you with comprehensive insights about safeguarding your forestry business.

Our transport insurance brokers maintain close ties with the transport sector in Christchurch and Canterbury, ensuring the uninterrupted flow of goods and vehicles throughout the region and across New Zealand.

Insurance within this domain can be complex, and we work alongside you to secure tailored insurance solutions, whether you are engaged in general freight, log cartage, or freight forwarding, meeting all the stipulations of your cargo agreements.

We also extend our offerings to encompass various aviation assets and liabilities, with specialised coverage tailored to a range of aircraft.

"*" indicates required fields

Privacy Policy | This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.