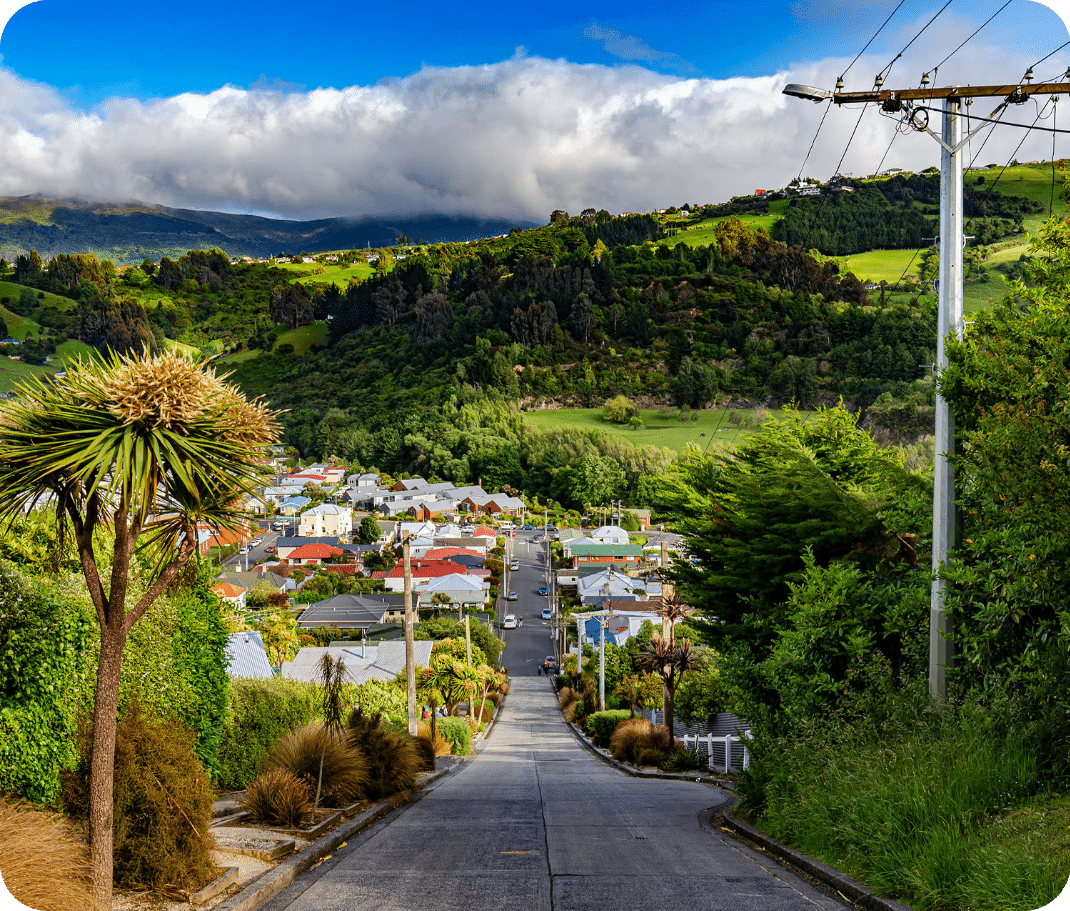

Your home, contents, and vehicles are valuable assets that deserve protection. Accidents, natural disasters, or theft can disrupt your life, but having the right insurance coverage can make recovery smoother. Our Otago-based brokers can arrange:

Home Insurance: Comprehensive coverage for repairs and partial or total rebuilds.

Contents Insurance: Protection against loss, theft, or damage to your belongings.

Vehicle Insurance: Safeguard your cars, motorcycles, and more.

Special Insurance: Tailored coverage for high-value items like caravans and jet skis.

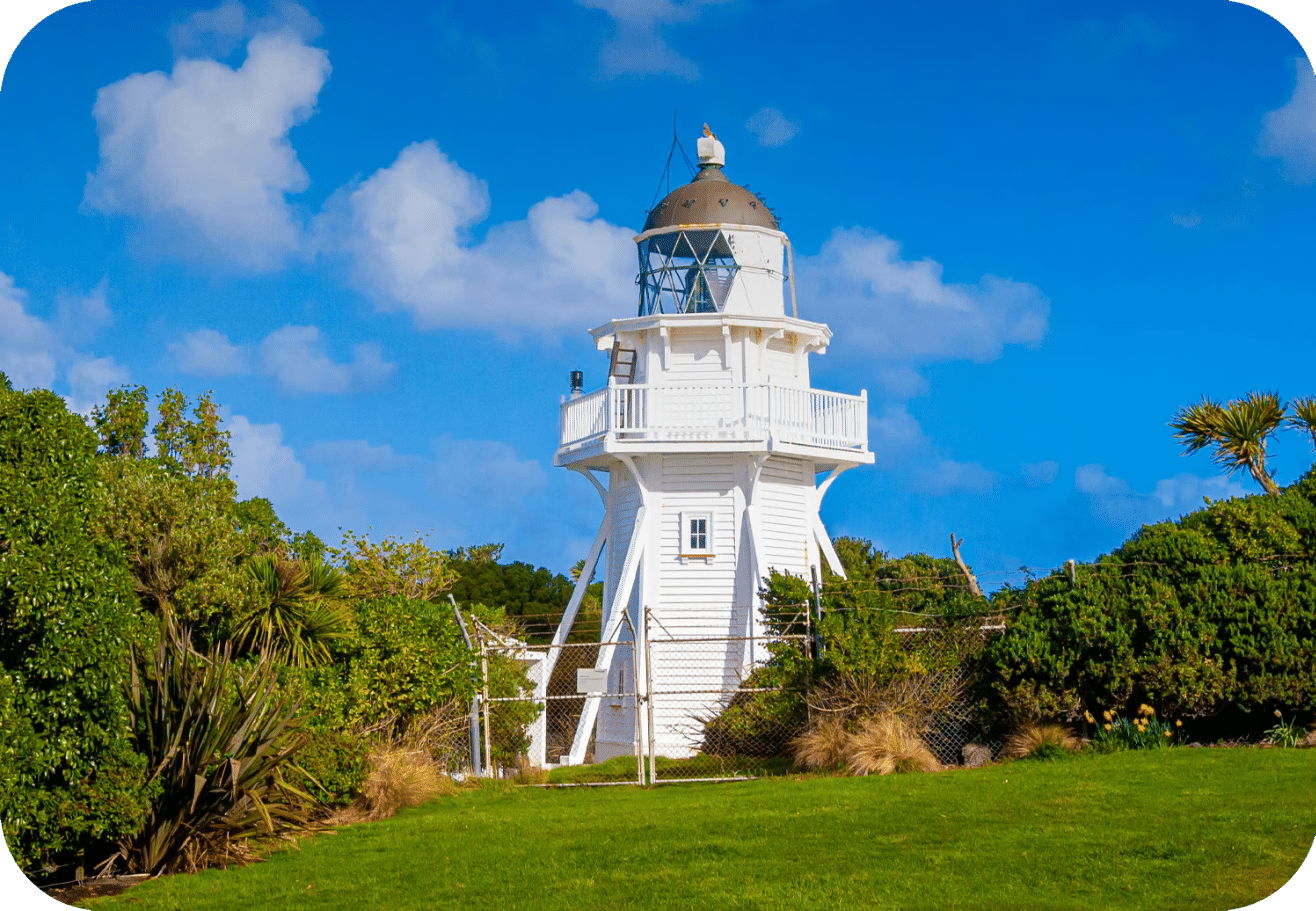

Specialist Property Coverage: We also assist with specialised insurance for Airbnb properties and lifestyle block owners who may require rural insurance.

Look no further than our local Otago team for all your personal insurance needs.

No matter the size of your Otago business, insurance is a vital safety net for owners and employees in the event of unforeseen disruptions. Our commercial insurance solutions are designed to reduce income loss and expedite the recovery process, ensuring you can get back to business as usual.

We arrange insurance for businesses of all sizes, as well as individuals, including tradies, consultants, professionals, and landlords. In an era of evolving cyber threats, our team can work with you to enhance your protection against these emerging risks.

Contact us to have a no obligation chat about your commercial insurance requirements.

For those managing rural properties in the Otago region, the challenges are significant. Weather events, crop and animal diseases, and environmental concerns are part of rural life. The right farm or rural insurance can provide peace of mind.

Our mission is to help Otago farmers secure the necessary coverage for their buildings, equipment, crops, and assets while also addressing liabilities such as health and safety and potential contamination issues. We also extend our expertise to rural contractors, ensuring they are comprehensively insured against accidents and liability breaches.

Don't hesitate to contact us today to discuss your specific rural insurance needs in Otago.

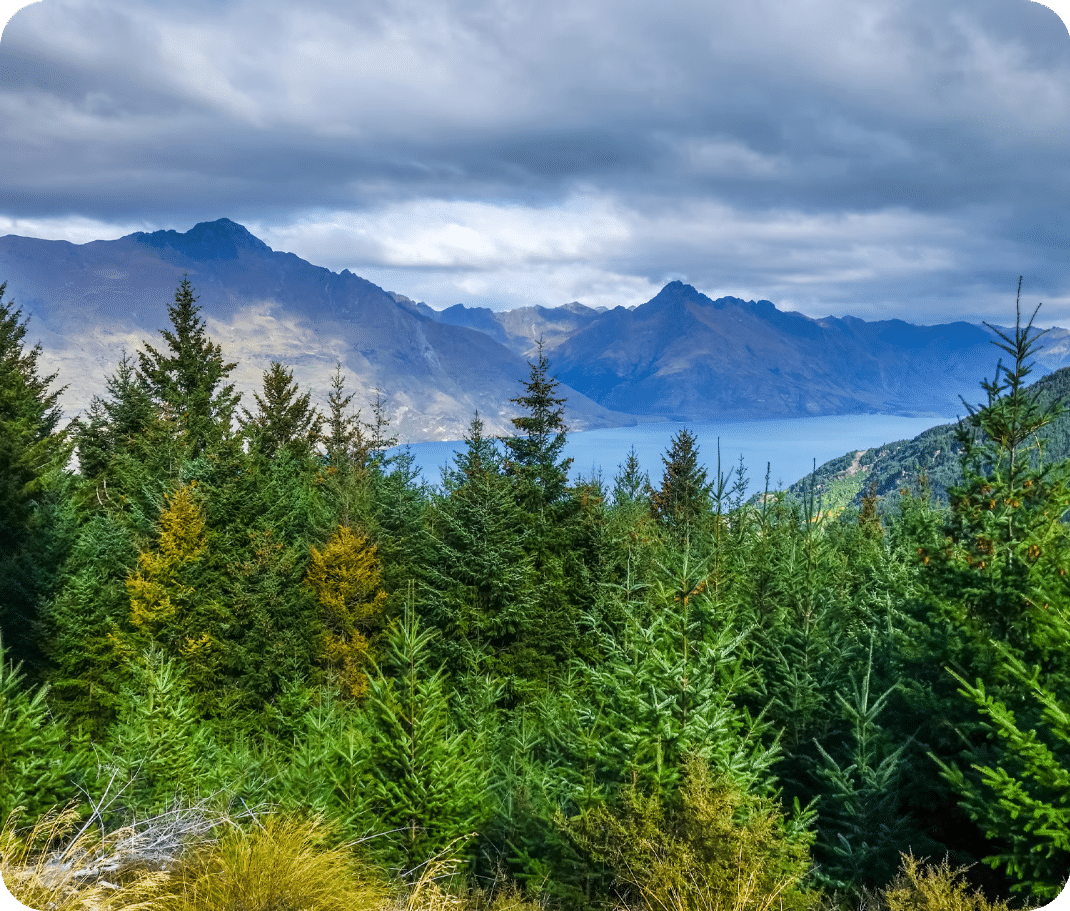

Our experienced forestry insurance brokers collaborate with Otago forestry operators to deliver custom insurance solutions that cater to your specific requirements. We understand that your needs can change over time, and our flexible insurance solutions are designed to adapt and evolve to meet those needs.

Contact us to speak with one of our specialised brokers and safeguard your forestry business in the Otago region.

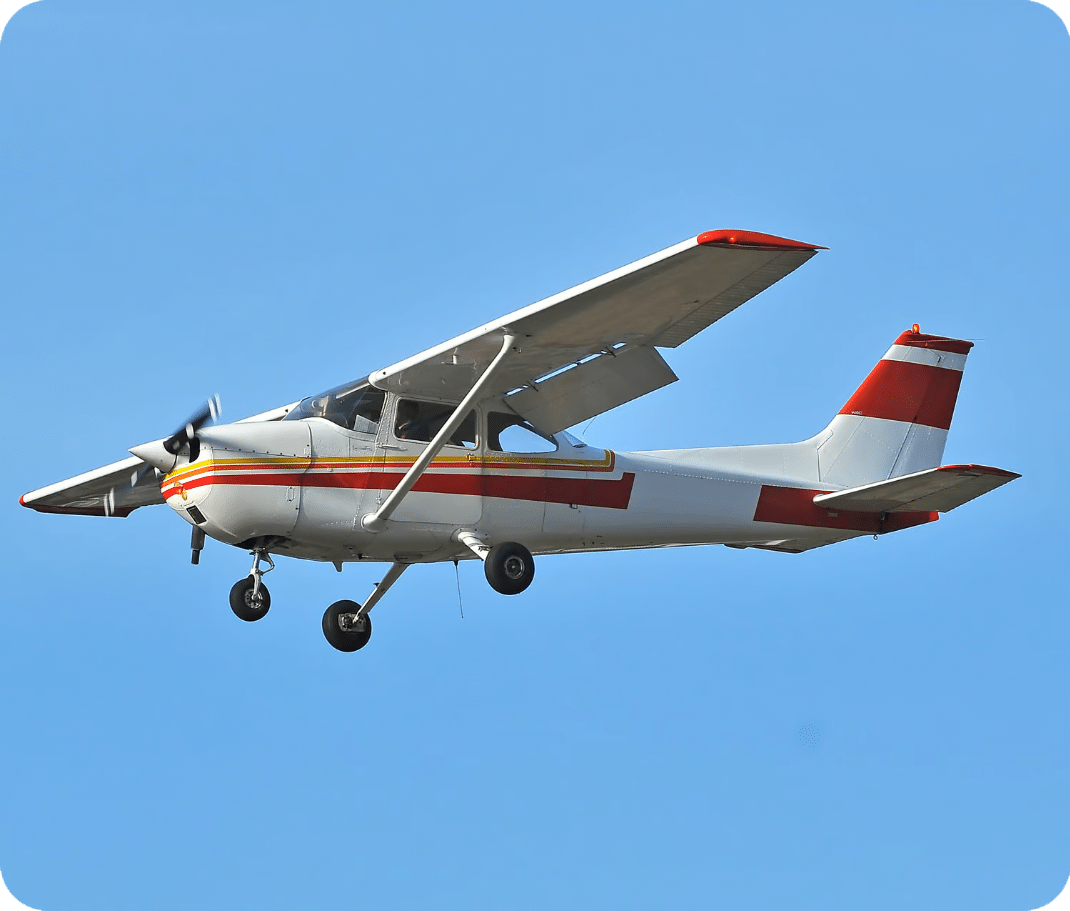

If you're involved in the transportation sector in Otago, our brokers can assist you with insurance coverage for your commercial vehicles, employees, and cargo. Whether it's general freight or log cartage, we work with a variety of transport operators and ensure that insurance policies align with cargo agreements and regulations.

We also offer insurance solutions for a range of small aircraft and boats, covering assets and liabilities with specialised coverage. Contact us today to explore insurance options that cater to your specific needs.

"*" indicates required fields

Privacy Policy | This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.